As the IT environment, and especially as applications evolve, the way in which they need to be monitored must evolve was well. Sometimes these changes in how things need to be monitored are not evolutions, but are in fact revolutions that usher in wholesale disruptions to the monitoring business. The last major disruption to the APM business occurred around 2008 when AppDynamics and New Relic were formed and when Dynatrace landed in the US from Europe. All three of these vendors were focused upon distributed N-Tier applications, and they ended up displacing the legacy APM vendors (IBM, BMC, HP and CA) in the Gartner APM Magic Quadrant after a few years.

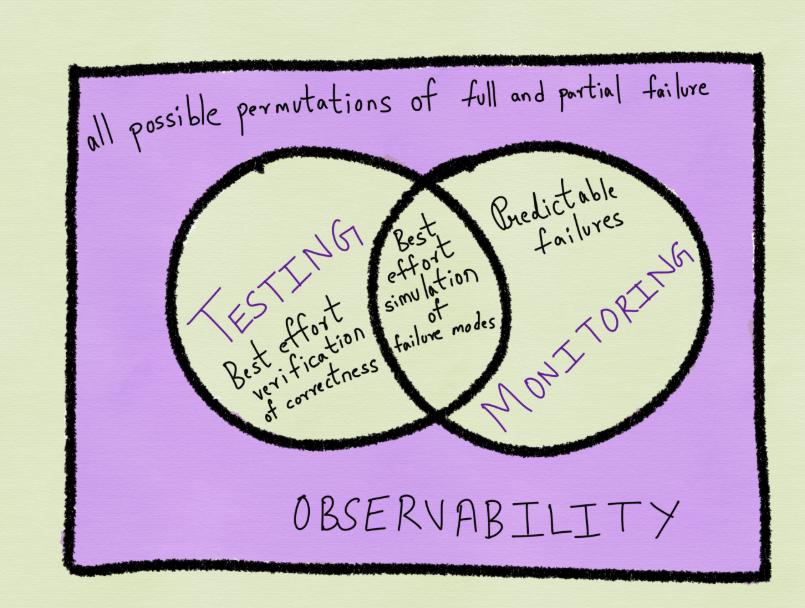

The Observability Disruption

We have become so accustomed to the pace of change and innovation in our industry, that it is possible that many of us have not noticed the revolution and disruption that has been occurring right before our eyes. This disruption is being driven by the following factors:

- The demand to implement business processes in software is infinite and is driven by Digital Transformation

- There is not enough capacity in terms of developers, testers, support teams (DevOps and SRE) and everyone else involved in the software to market process to keep up with this infinite demand. This imbalance between demand and supply is driving a series of innovations.

- New languages (Go, Python, PHP, Scala, JavaScript) get created to better fit certain kinds of applications and application components

- New runtimes and frameworks (SpringBoot, OpenShift) get created to better run applications in production

- New processes (Agile, DevOps, CI/CD) get created to speed the process of code and fixes to code into production

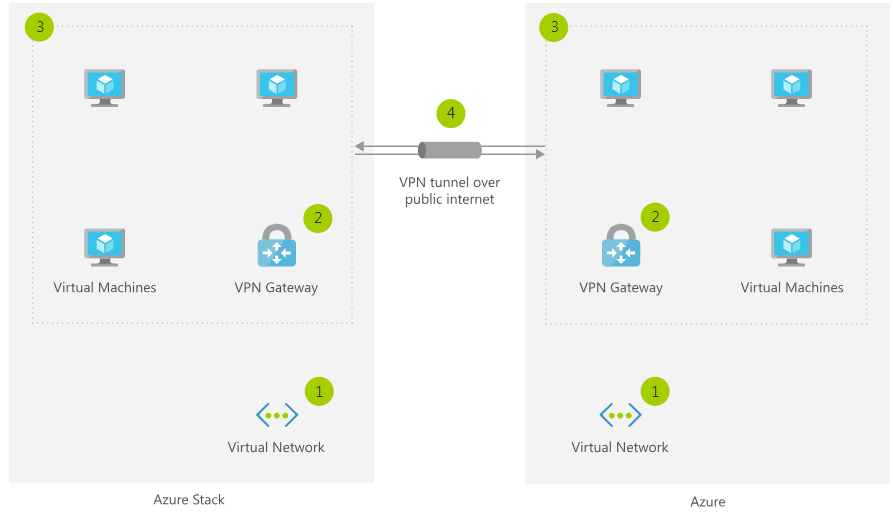

- The operation of applications in production is now highly dynamic – managed by Kubernetes and its derivatives

As a result of the above changes, applications are now very diverse, run on very diverse software infrastructure, are very rapidly being evolved (sometimes many times a day) and are very dynamic in operation (containers being scaled up and down with great frequency)

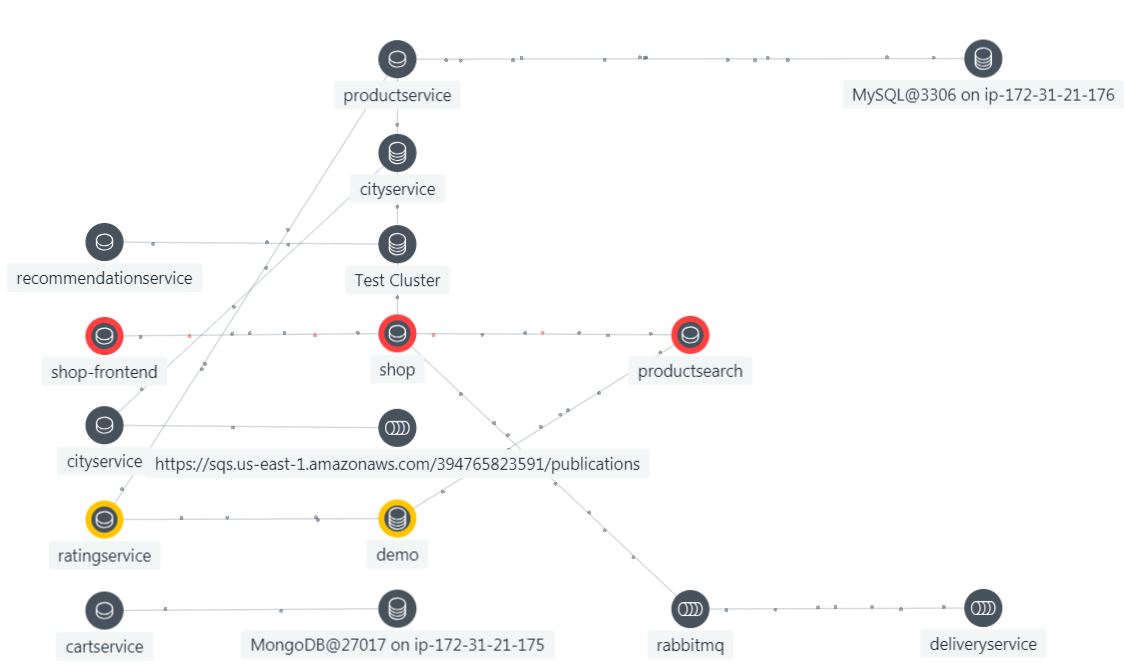

The Explosion in Things and Ways to Monitor

Along with the above changes there are ever more things (like the Internet of Things) that need to be monitored, and ever more ways to monitor them. There is an explosion in open source products and projects (StatsD, CollectD, LogStash, Beats, Prometheus, OpenTracing, Open Telemetry) all of which can easily collect a type of data (metrics, logs, traces, dependencies) from a subset of the things of interest. So now the diverse hairball of rapidly changing applications is being monitored by a diverse hairball of approaches and agents making all of this into a massive challenge for enterprises to keep up with and for vendors to cope with and support. So now the question for the monitoring vendors is how to cope with both the diversity of things that need to be monitored, and the diversity of the data sources that monitor them. “Cope” means more than just dumping this data into a data store and letting people who know what they are looking for search on the data. “Cope” means add value in terms of structure and relationships to data that is not inherently structured or related to anything.

The New Relic Telemetry Platform and Pricing in New Relic One

New Relic was a pioneer in the APM space in the 2009 time-frame as it was the first vendor to offer APM on a SaaS only basis, the first vendor to support programming languages besides Java and .NET, and the first vendor to turn the public cloud vendors into sales channels. With this history of innovation and disruption behind it, driven by the Founder and CEO of New Relic, Lew Cirne, it should not be surprising that New Relic has come up with both a disruptive product offering, and disruptive pricing. It should be clear that these actions on the part of New Relic are driven by three different dynamics:

- Datadog has successfully disrupted the cloud infrastructure monitoring space at a price point of $15 per month, and has built a very rapidly growing business around monitoring the software infrastructure (the layer of software between the operating system and the application) in public clouds. Some of this growth on the part of Datadog has negatively impacted the growth of New Relic, and this new product and pricing is in part a reaction to that problem.

- New Relic fully buys into and understands the diversity in modern applications, their rate of enhancement, their dynamic operations, and the diversity in open source tools that customers want to use to monitor this broad set of applications.

- New Relic understands that customers have not wanted to deploy APM broadly (to all of their servers) and that the way in which APM has been packaged and priced has been a major inhibitor to customers deploying APM much more broadly.

To address the above problem and opportunity, New Relic One now has three components:

- The New Relic Telemetry Data Platform – This is the back end database that serves all of the New Relic customers, and New Relic now allows customers to send it data from as many New Relic agents as they would like and as many supported open source tools as they would like. You can read more about the New Relic Telemetry Data Platform here.

- Full Stack Observability – This is licensed on a per user seat basis.

- AI and ML Services – This is licensed on the number of Alerts and AI transactions processed by the New Relic back end.

The pricing for the three options above is summarized on the New Relic Pricing Page.

What is Disruptive about These New Options from New Relic?

In order for this new pricing and packaging to be a long term advantage for New Relic, it has to be based upon some sort of sustainable competitive advantage. New Relic believes that the efficiency with which the the New Relic DB can ingest and process data gives New Relic a fundamental cost advantage over any other vendor whose back end is cobbled together out of commonly used open source technologies (Cassandra and Elastic being the most common two). This leads to the following potentially disruptive advantages for New Relic:

- The price to have the Telemetry Platform ingest your monitoring data (irrespective of its source) is $.25 per GB per month. If this ends up being materially cheaper for customers (after the per user and AI charges), and competitors are unable to match this pricing, then New Relic will have garnered a substantial and disruptive advantage in the APM and Cloud Infrastructure Monitoring markets.

- If it turns out that customers will be able to scale out monitoring to a broad set or perhaps even all of their servers in a cost effective manner because of this pricing and packaging then New Relic will have solved a long standing problem in the APM space – that being that only about 10% of the servers that could be monitored by an APM solution are being monitored by an APM solution.

- The existing per node or per server pricing on the part of APM vendors is a disincentive for customers to break their applications into microservices and to then run those microservices on many different individual servers (for reasons of redundancy and scalability). This pricing and packaging is then potentially extremely attractive to the very customers who are at the leading edge of adopting new application architectures like microservices and serverless approaches. Capturing the most rapidly growing set of customers is always a very attractive thing for a vendor.

Summary

This new pricing and packaging for New Relic One is a bold move to turn the tables on a diverse set of competitors including AppDynamics, Datadog, Dynatrace, Instana, Elastic and Splunk.