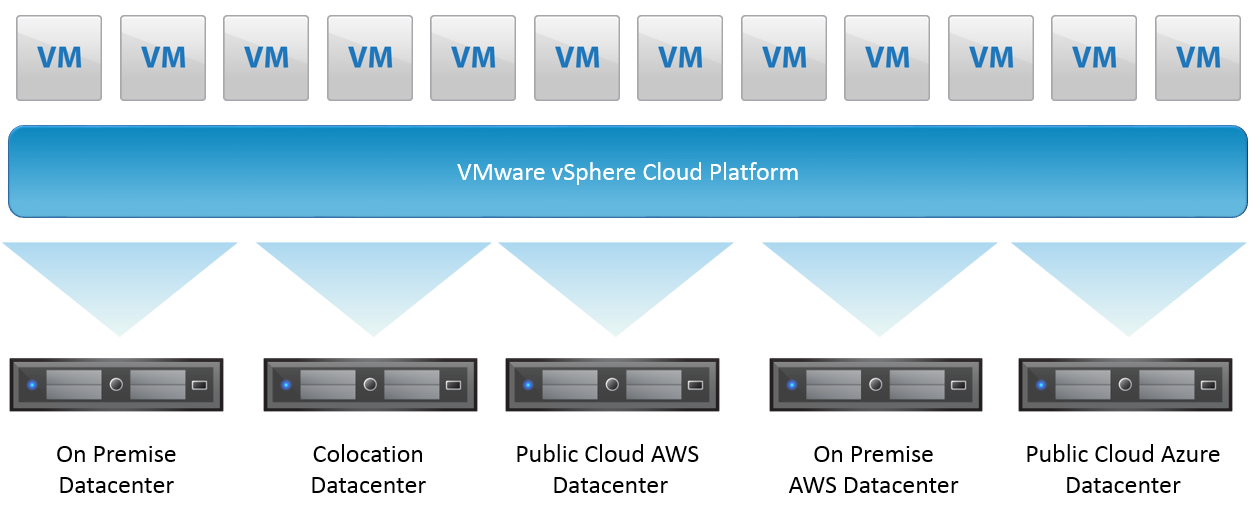

It can be argued that VMware was the first vendor to deliver a credible enterprise cloud offering with vSphere and its add-on set of management offerings (now called the vRealize Suite). While most of VMware’s customers got started with VMware to get the benefits of consolidation, availability, and centralized management of disparate operating systems, self-service clouds quickly grew up on the VMware platform aided by the cloud management offerings of VMware and many third party vendors. Some estimates are that VMware now has over 200,000 customers and over 20 million VM’s (Cloud Images) under management. The vast majority of these VM’s run on servers owned by the enterprise that run either on-premise or a a co-location data center.

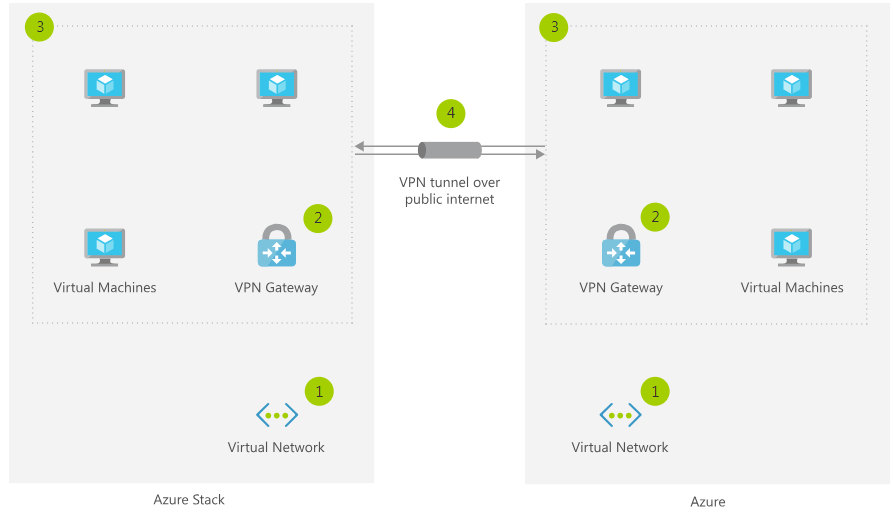

Microsoft has the largest installed base of systems software (Windows Server and Windows Desktop) of any vendor on the plant. It has been including its virtualization offering, Hyper-V in Windows Server for quite some time, but has never made a real dent in the enterprise virtualization installed base of VMware. Microsoft also runs the Azure Cloud which currently stands in the number 2 position behind Amazon with AWS. Microsoft has recently made its Azure offering available on-premise with the Azure Stack.

Amazon with AWS invented public cloud computing and holds the market leadership position in public cloud computing with both the richest set of offerings and the largest installed base.

July 30 2019 update – VMware and Google have announced a partnership with which you can now run the VMware Cloud Foundation software on the Google Cloud – https://ir.vmware.com/overview/press-releases/press-release-details/2019/Google-Cloud-and-VMware-Extend-Strategic-Partnership/default.aspx

The Enterprise Cage Fight Between AWS, Microsoft and VMware

In August of 2017, VMware announced the VMware Cloud on AWS. Quite simply this meant that an enterprise vSphere customer could rent a server in Amazon from VMware, and seamlessly extend their VMware Cloud Platform from its existing footprint in the enterprise’s datacenters over into the various AWS regions. Everything except the location of the workload stayed the same. The customers were able to use VMware’s extremely popular tools like vMotion (to live migrate VM’s) and DRS (to automate the live migration of VM’s) seamlessly across their own hardware and that own by AWS in the AWS datacenter. So at this moment, VMware and AWS became both partners and competitors.

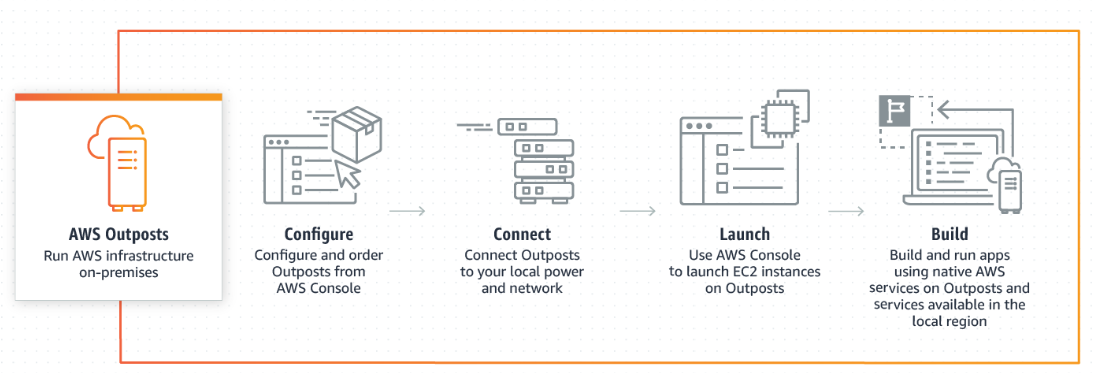

In November of 2018, Amazon announced AWS Outposts. This allows customers to extend the entire AWS stack to their own on-premise and co-location datacenters. So now enterprise customers have the same option of running a single vendor’s software across the servers in the cloud and their own servers from Amazon as well as VMware. To make this even more interesting, it is also possible to run VMware vSphere on AWS Outposts so is is now possible to run VMware vSphere on servers up at AWS, servers from Amazon in your own datacenter and servers you own.

In April of 2019, Microsoft, Dell, and VMware announced the ability to run VMware vSphere on bare metal Microsoft Azure servers. This had the effect of turning VMware and Microsoft into both partners and competitors as if the VMware AWS arrangement was not already confusing enough.

What is Really at Stake Here?

What is going on here is that we have three very large, very innovative, very well financed and very capable vendors battling for the ownership of the cloud platform business spanning on-premise, co-located and public cloud data centers. You have to hand it to all three vendors for their willingness to work with competitors to give customers choices.

VMware vSphere Deployment Options

AWS Outposts Deployment Options

Microsoft Azure and Azure Stack Deployment Options

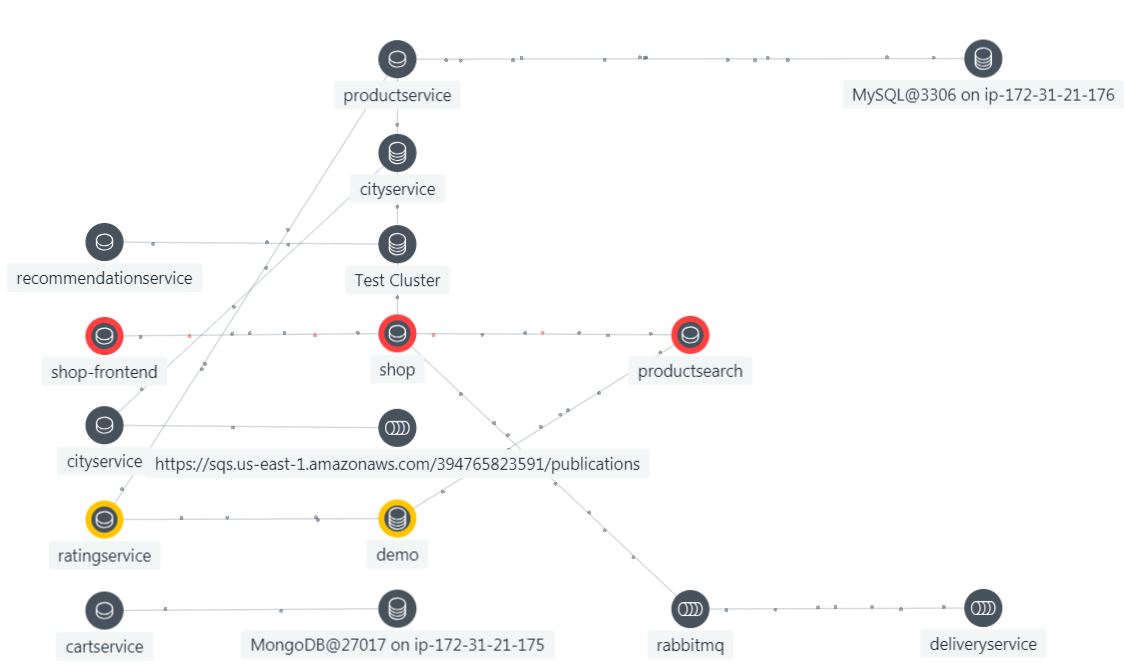

The Wild Cards – Kubernetes and Docker

Just in case you were lulled into thinking that this was a three horse race between three of the giants in our industry, not so fast. Because there is an entirely new way to run workloads – that being in Docker containers and orchestrated (managed) by Kubernetes. Docker and Kubernetes are in no way ready to replace any of the cloud platforms from VMware, AWS or Azure. In fact all three cloud platform vendors are working as hard as they can to incorporate Docker and Kubernetes into their cloud platforms. However, all we need is the ability to migrate running Docker containers (Kubernetes Pods) between hosts (Kubernetes Nodes) and all of a sudden the cloud platform vendors are going to have a whole new competitive scenario to worry about.

What’s an Enterprise to do?

There are two extremely important decisions that enterprise cloud architects have to make in this area. The first is whether to optimize for time to market and agility and to therefore use the cloud services and API’s of a cloud platform vendor deeply – having the effect of locking that application into that cloud platform. Or to consciously use only the “Infrastructure as a Service” and maintain portability across clouds. Using a cloud abstraction layer like Red Hat OpenShift can also greatly ease portability across clouds.

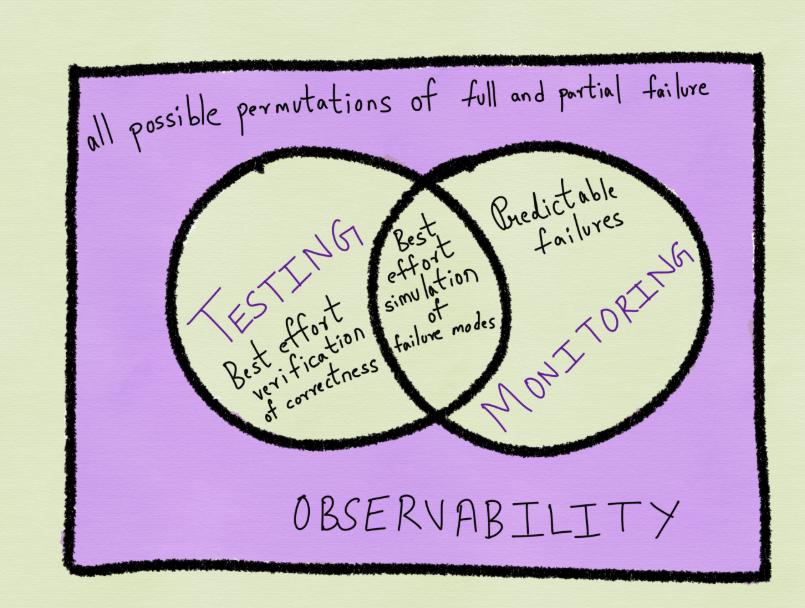

The second big decision is how to make sure all of these next generation software services and applications fueled by your digitalization and digital transformation initiatives are actually working as you need them to. This gets into monitoring which will be the subject of further articles.